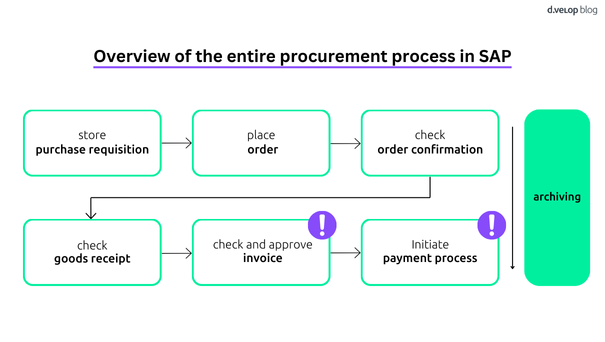

Our series of blog articles on the digital procurement process in SAP continues. After having a closer look at the entire purchase-to-pay process and, a few weeks ago, SAP purchase requisitions (BANF) and SAP goods receipt, we are now focusing on SAP invoice verification. In this process step, the motto is: “It’s all about the money”! The focus here is on the receipt of invoices and the subsequent payment process. We are at the following point in our SAP procurement process:

Invoice verification and invoice approval process – the problem with conventional invoice processes

Checking and approving an invoice in the company alone takes up to 14 days on average. In half of all cases, the three-document check (order, delivery bill, invoice) also fails.

Process costs without automatic invoice verification

On average, 5.25 employees are involved in processing an invoice, and 0.50 % of all invoices are even lost within a company. These are the figures published by the Leibniz University of Hanover’s Institute for Information Systems on the subject of electronic invoices. As a result, it is hardly surprising that processing a single invoice can quickly cost up to 12 €.

Just do the math for your company. One thing is certain: Tasks that are described by employees as supposedly “routine” and which at first glance appear to be done effortlessly and incidentally cost the company an incredible amount of money in total.

How do I optimise my SAP invoice verification?

How do these costs come about? They result from the answers to the following questions, which every company must answer for itself during the SAP invoice verification process:

- Who is responsible for checking the content of the invoice and is authorised to carry out the arithmetical check of the invoice?

- Who is responsible for the cost centre?

- To which employee must the incoming invoices be distributed?

- How do I get an overview of all incoming invoices that are still open?

- How can I guarantee audit-proof archiving of the documents?

- How do I avoid duplicates and therefore printing costs?

It is therefore important to ensure that invoices are distributed, checked, approved, and posted as quickly and accurately as possible. This is the only way to give your company a constant overview of all short- and medium-term trade payables. You can optimise your processes if you design your invoice verification digitally and automatically.

Optimised workflow for your invoice verification: Automatic SAP invoice verification

It would be particularly practical if you could carry out all steps of the A/P invoice verification directly in your ERP system for your automated SAP invoice verification, wouldn’t it?

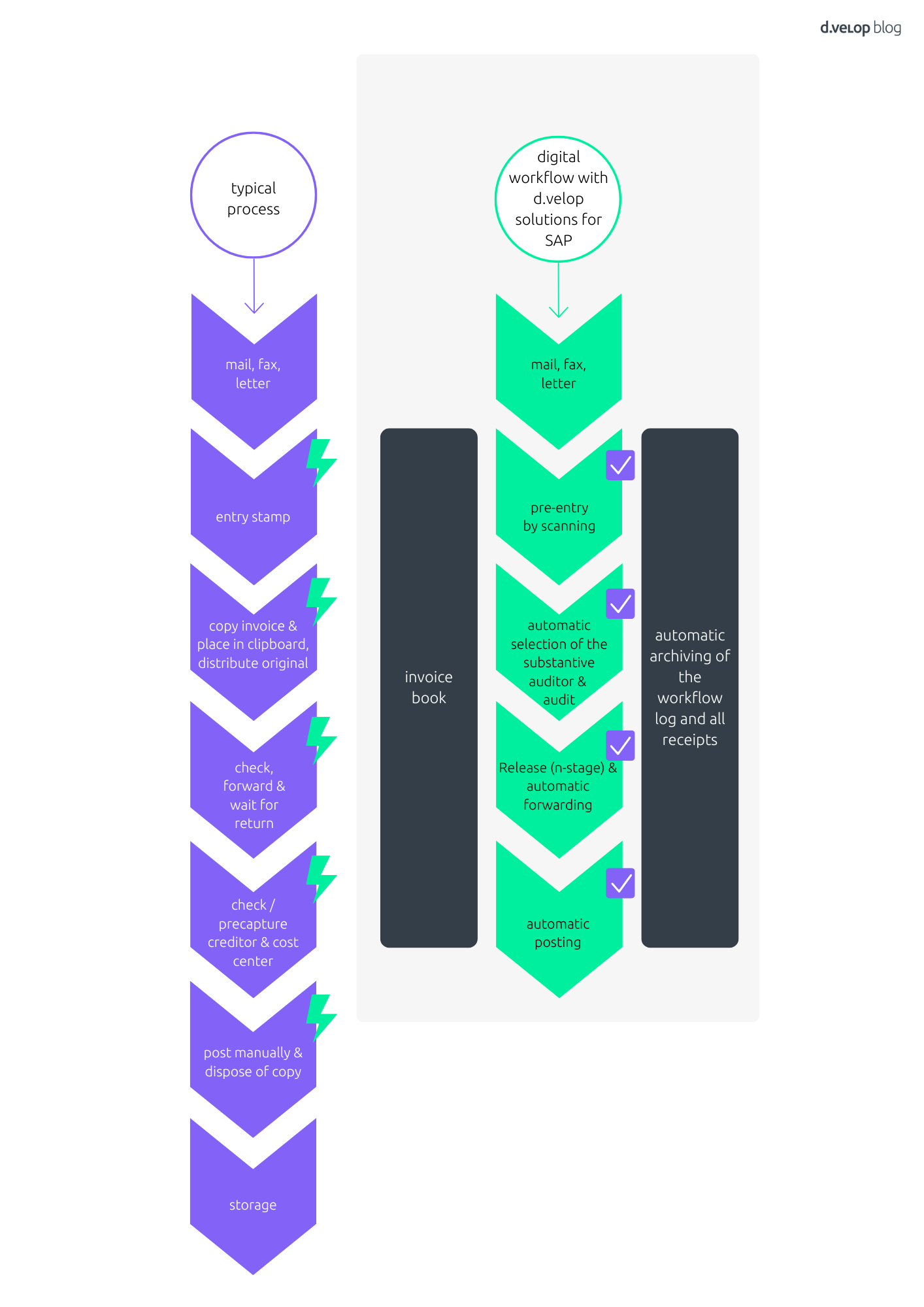

Let’s compare a non-automated incoming invoice process with the automated incoming invoice process in SAP.

The comparison: non-automated vs. automated SAP invoice verification

Non-automated SAP invoice verification: high process costs due to long run, processing, and idle times

Invoice receipt and manual pre-assignment

In the classic incoming invoice verification, the first step is to receive the invoice by e-mail, fax, or letter. After opening or printing, the document must be stamped with a receipt stamp, and a manual pre-account assignment is carried out.

Copying and manual distribution of incoming invoices

The next step consists of copying the invoices and storing the copy on a clipboard. The original document is distributed within the company via internal mail or in person. As you probably know, this procedure can be very time-consuming. Frequently, colleagues are simply not found, and the accountant has to send the invoice on its way again the next day or week. In addition, organising the copies on the clipboard is extremely time-consuming. Copies that are not sorted out after receipt of the original invoice can very quickly lead to confusion and incorrect assumptions.

Manual invoice verification and invoice approval process

The next step in the process involves checking, forwarding if necessary, and approving the invoice. At this point, it is necessary to find out who can check the invoice. Often, order numbers or purchasers are not transferred from the original order to the invoice from the supplier. This means that when the invoice arrives at the substantive reviewer, the latter has to search for and compare the order in the system. Following the check, the invoice is sent back to the financial accounting department by post. The processing status cannot be recognised in the system by the Head of Finance and Accounting. Even if invoices are forwarded within the company, the current status and who is processing the invoice are not always known.

Manual invoice entry and invoice posting

The invoice is then returned to financial accounting. The vendor and cost centre are checked here. The cost centres that have now been specified or corrected are checked again. Here too, any queries from the departments are to be expected. The accountant must now enter the invoice manually in the system (if it has not been pre-entered) and post the invoice. There are also hidden sources of error here. The copy created must be disposed of, and all documents filed again manually.

A Few Steps to Automated Procure-to-Pay Processes in SAP

Gain insight into what a digital procurement process looks like and its benefits over the traditional process.

Automated invoice verification in SAP: process transparency thanks to the incoming invoice ledger

Automated invoice capture thanks to scanning software

In the automated process, invoices arriving by post are captured using a batch scanner. Receipts that arrive at the company by fax or e-mail are automatically captured by scanning software. During the scanning process, the most important data is read out using OCR. For example, you can automatically add the cost centre to the receipt after initial capture.

Fully automatic pre-recording in the incoming invoice book

For orders without a purchase order reference, the system automatically carries out a preliminary entry if required, and the invoice appears in the A/P invoice ledger. The incoming invoice ledger is the central cockpit for all incoming invoices. It shows at a glance which invoices have been received from which vendor, in what amount, and with what discount period. The processing status and the current processor are also visible. This eliminates the need for queries regarding the status of the invoice and provides complete transparency and information on all incoming invoices received by the company.

Automatic distribution for SAP invoice verification

In the next step, the documents are immediately forwarded to the ordering parties via workflow. Invoices are distributed to the responsible persons much faster, in a more targeted manner, and without a great deal of effort. This saves a lot of time, and organisational costs can be greatly reduced. An automatic workflow also forwards the order directly to the ordering party based on the data read from the OCR scanner. The forwarding data is updated in the incoming invoice book, and the head of finance and accounting knows the processing status and the current processor of the invoice.

Electronic invoice verification in SAP: Automatic workflow in your invoice verification

During the actual SAP invoice verification, the auditor receives an automatic comparison between the purchase order, the posted goods receipt, and the invoice. Quantities and totals are therefore compared. If the invoice is shown as “green”, then the three-document check is correct, and the auditor can transfer the invoice to the workflow as checked by ticking the box. If the relevant employee has been selected via workflow, the invoice can now be approved immediately based on the previous comparison between the goods receipt, purchase order, and invoice – if desired, also on mobile devices and without SAP access by managing directors or department heads. An n-stage invoice approval can also be stored in the SAP system here.

Automatic posting after successful SAP invoice verification and invoice approval process

Once the invoice has been approved, it can simply be posted with a click of the mouse and made available for the payment process. All documents and edits relevant to the process are automatically archived, and the invoice is also automatically deleted from the incoming invoice ledger after posting.

The following graphic shows a comparison of the two processes:

The automated SAP invoice verification process is significantly shorter and less error-prone. The sub-steps of SAP invoice verification can be completed more quickly and easily. This brings significant advantages when viewed as a whole.

All the advantages of SAP invoice verification at a glance

- Process transparency thanks to the incoming invoice ledger

- Reduction of processing and waiting times

- Timely utilisation of cash discounts

- Position-specific factual examination

- Variable mapping of company processes in the workflow

- Cross-location checking and approval

- Central data management without redundant copies

- Automatic determination of processors

- Audit-proof filing and SAP archiving of the workflow log

Now that the advantages have been clarified, the only thing missing is the right solution. The d.velop incoming invoice automation for SAP ERP is a solution specially developed for SAP that digitalises and automates manual invoice processing procedures.

💻Book Software Demo

Experience the power of d.velop’s software with a personalised live demo, easily requested with just a few clicks. Watch as the software comes to life before your eyes and ask any questions you may have in real-time.