Finance and Accounting personnel are responsible for the processing of a high volume of invoices daily. Typically, multiple team members are involved in processing each invoice, including receiving, checking and posting. Given the number of steps and people involved, there is significant potential for optimisation throughout the entire process. We are pleased to provide an explanation of our digital SAP Invoice process and the resulting benefits.

SAP Invoice: Efficient processing through digital processes

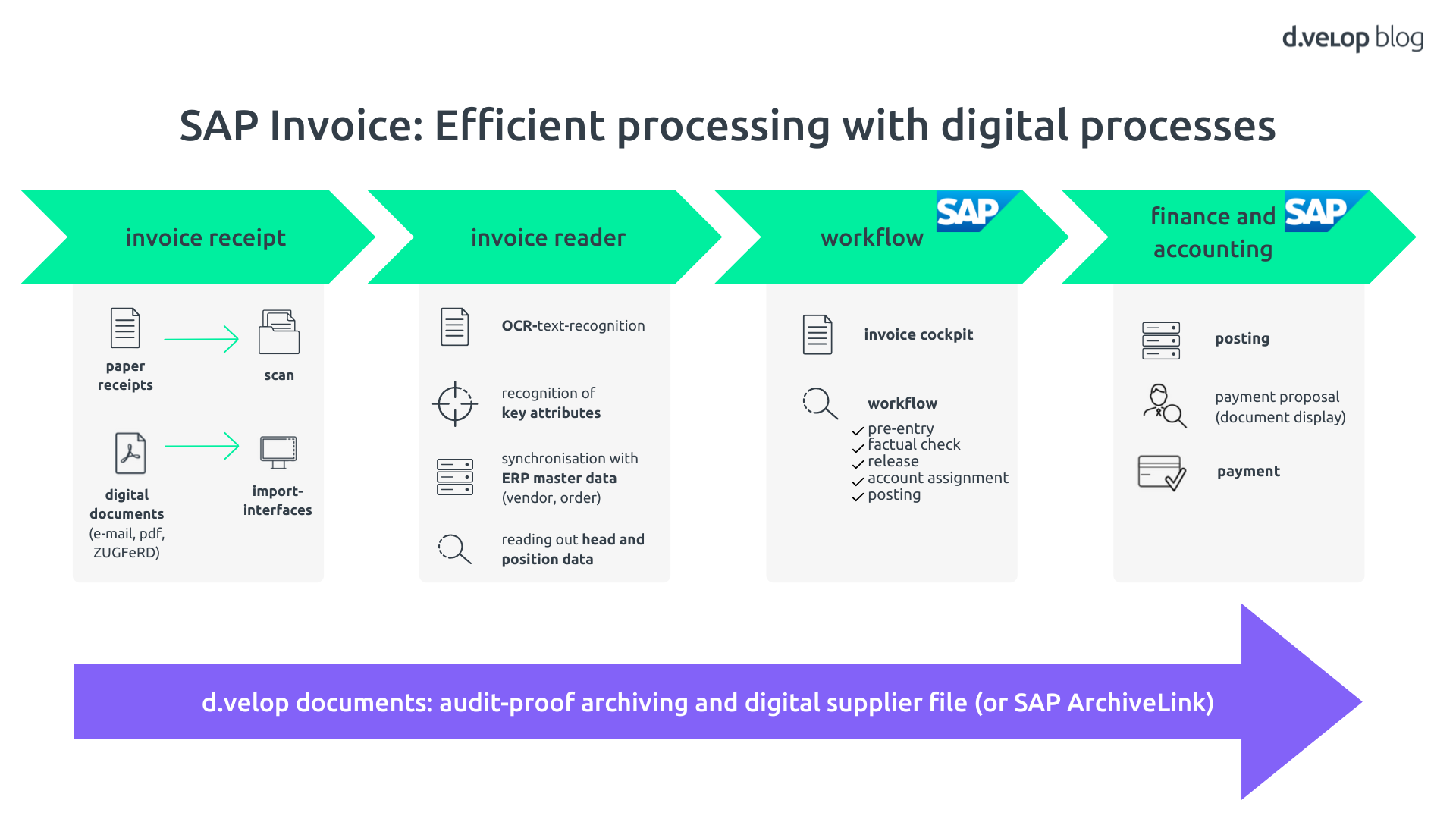

d.velop Invoices for SAP is designed to facilitate end-to-end digitalised invoice processing within the SAP system. Firstly, it facilitates the capture of invoices: These invoices can arrive in a variety of formats and via different channels. Paper documents are digitised via scans, and invoices received electronically are read out via an import interface.

Digital invoice processing 🚀

This white paper explains the advantages you gain, the possible obstacles you may face and describes the necessary framework conditions you need to have in place.

Classify data

The next stage of the process is to capture, read and classify the invoice. This is achieved by comparing the invoice data with the header and footer data, as well as relevant SAP master data. Paper documents are then processed using OCR software to capture all invoice data and generate a digital document. Electronic invoice formats are transferred and classified directly into the software using an import interface.

Comparison with SAP master data

In this step, the invoice data is automatically recognised and recorded. The invoice can be assigned directly to the company and a supplier by comparing it with the SAP master data. The software can also read the items and values of the invoice and assign them to existing orders. Based on the recognised vendor and company code, the document reader invoice can independently make suggestions for account assignment (e.g., G/L account and cost centre). The continuous enhancement of recognition accuracy is a perpetual process. By adapting and completing the data during ongoing processing, the software continues to learn in the form of auto-training and becomes more efficient.

Data management with SAP Invoice

Once the invoice has been automatically read, it is transferred to the SAP Invoice Cockpit. This centralised system provides a comprehensive overview of all invoices that have been processed. The Cockpit provides a comprehensive view of the status of all incoming invoices and credit notes, including processor, processing status, invoice amount, vendor, currency, discount period, and numerous other customisable criteria. This provides comprehensive transparency, facilitating the timely meeting of discount deadlines and ensuring the status of the invoices is always known.

The invoice workflow is initiated from the invoice Cockpit. Rules are defined for the assignment of the respective processors or processor groups, which make it possible to automatically assign the correct processor as soon as the invoice is entered. The assigned processor will then be able to see the invoice in the invoice cockpit and will be informed directly via their inbox (notification via e-mail or SAP Business Workplace) about the pending activity. This is followed by a review and approval process defined as part of a workshop. This process can be defined based on invoice types, vendors, product groups, amounts, and many other criteria. Once the checking and approval process has been successfully completed, the invoice is posted in Finance and Accounting. Following the posting of the invoice, a digital payment proposal list is then generated, providing all the information necessary for checking and payment, thus finalising the process with the vendor.

The digitalisation of invoice processing in SAP offers 5 key advantages

1. Time saving

SAP Invoice is an efficient system that saves processors a considerable amount of time by providing a centralised overview of all invoices and their status throughout the entire process. The automated workflows ensure that all the involved processors and substitutes are informed immediately, thus eliminating the need to search for information manually.

2. Cost savings

In addition to the financial benefits of reduced paper and printing costs, automated workflows allow for more efficient processing of invoices, leading to a reduction in the time processing invoices. There is one designated processor and, if required, a deputy. This approach eliminates the need for extensive coordination, enhancing efficiency. Automatic invoice data classification eliminates the need for manual data entry. For MM invoices (with order reference), the invoice can even be posted without any involvement of a processor.

3. Transparency

All incoming invoices are centrally managed in the invoice cockpit, ensuring complete transparency. Automated workflow logs are generated after the final posting of each invoice, enabling the entire invoice processing procedure to be traced.

4. Lower error rate

The invoice reading process is the foundation for achieving a lower error rate. The automated reading of invoice data, and comparison of order data in combination with auto training prevents input errors.

5. Automatic audit-proof archiving

Once an invoice has been entered, it is automatically archived in an audit-proof and GOBD-compliant manner, for example, using the ArchiveLink interface. This eliminates the need for manual, separate archiving of documents. The documents are linked to the SAP posting document and can be accessed there at any time for auditing purposes.

Book a Software Demo 💻

Curious? Then get to know the software in a personalised live demo. Simply request a non-binding appointment.