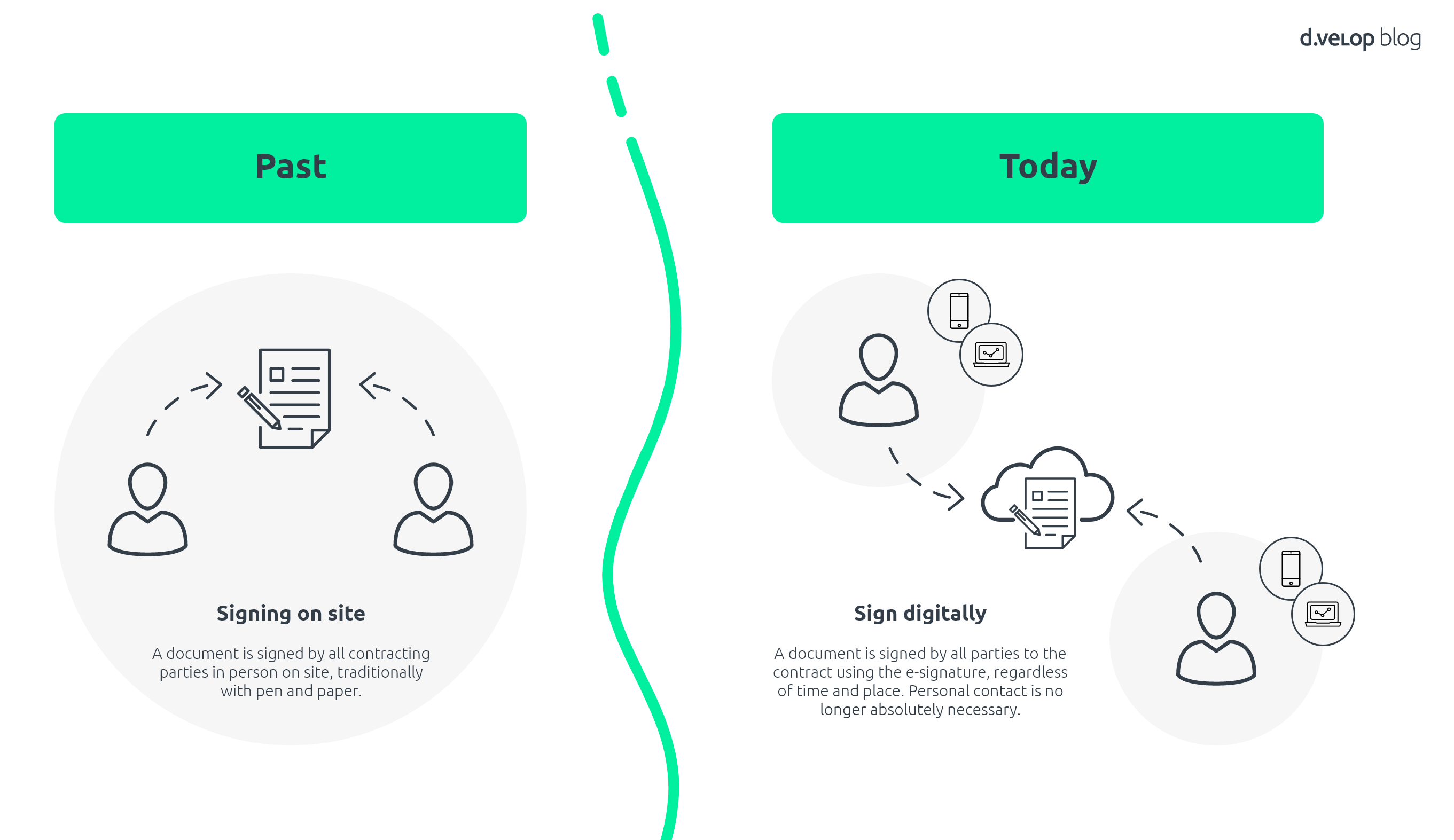

In today’s working world, companies are increasingly trying to rethink paper-based processes with digital alternatives. The focus is particularly on their own contract management. One term that comes up again and again in this context is the qualified electronic signature (QES for short). But what is a qualified electronic signature anyway? What specific advantages does it offer? And what are the requirements and application scenarios? In this article, we will provide you with the necessary knowledge so that you too can participate in digital progress and get started in your day-to-day work.

What is a qualified electronic signature?

The qualified electronic signature (QES) is a special form of electronic signature that is regulated in the European eIDAS Regulation. The eIDAS Regulation (electronic Identification, Authentication and trust Services) creates a standardised framework for the use of electronic signatures in the European Economic Area. The standardised set of rules creates security for companies and reduces administrative hurdles. The eIDAS Regulation distinguishes between three different signature levels:

- the simple electronic signature (EES),

- the advanced electronic signature (FES) and

- the qualified electronic signature (QES)

The qualified electronic signature (QES) is the highest level of the three e-signature standards and is the most secure form of digital signing due to its high requirements for the identity of the signatory. Furthermore, the QES fulfils the legal written form and thus represents the digital equivalent of a handwritten signature on paper.

Sign documents with the digital signature in a legally secure way 💻

What are the advantages of a qualified electronic signature?

But why should companies even bother with qualified electronic signatures and the associated regulations? And why should employees rely on the digital process and say goodbye to the familiar signature on paper? You should definitely be aware of these six advantages of the qualified electronic signature:

- Reduce process costs: Save the costs for paper, printing and dispatch and become independent of new cost increases, e.g. due to postage increases

- Save time: An optimised signature process reduces processing times from several days to just a few minutes.

- Sign regardless of location: Avoid unnecessary physical travelling to sign contracts – sign when and where you want!

- Eliminate media disruptions: No more travelling to the printer or scanner – experience an end-to-end digital process without media disruptions. From creating the contract to signing and archiving in just one system.

- Conserve natural resources: Make a real contribution to a more sustainable working world, e.g. by reducing CO₂ (avoiding travelling, deforestation).

If we summarise all the aspects, one key added value takes centre stage: flexibility. Signing documents, no matter when and where – a piece of the puzzle that is simply part of the digital workplace in times of remote work and new work. Once the benefits have been recognised and experienced in everyday life, nobody wants to do without them. The qualified electronic signature (QES) therefore represents a win-win situation for everyone involved.

What requirements must a qualified electronic signature fulfil?

As we have already learnt, the qualified electronic signature (QES) is the most secure form of digital signature due to its high requirements for the identity of the signatory. But what exactly are the requirements? In order for the qualified electronic signature (QES) to be used, a certified trust service provider must verify the identity of the person in question. With regard to the qualified electronic signature (QES), providers of signature software work together with these trust service providers.

Trust service providers (TSP)

Trust service providers are companies or organisations that offer digital services to ensure the confidentiality, integrity and authenticity of electronic transactions and documents. In Germany, for example, trust service providers include Deutsche Telekom, Deutsche Post, D-Trust (Bundesdruckerei), the Federal Chamber of Notaries and the Federal Network Agency. In Switzerland, on the other hand, you often come across Swisscom Trust Services. The legal framework of these providers is regulated in the Trust Services Act.

At the beginning, the respective person sets up an account with the trust service provider. The person then undergoes a one-off identification procedure (e.g. eID, Video-Ident or PoS-Ident). Successful verification creates the basis for initiating legally secure signature processes with the QES in the future. These 3 steps are ultimately carried out when using the qualified electronic signature:

- Start the signature process and select the QES as the signature level

- Confirm identity: Before the signature can be applied to the document, the signatory must log into the user account of the respective trust service provider (1st factor) and request a TAN number, which they then confirm in the signature software (2nd factor).

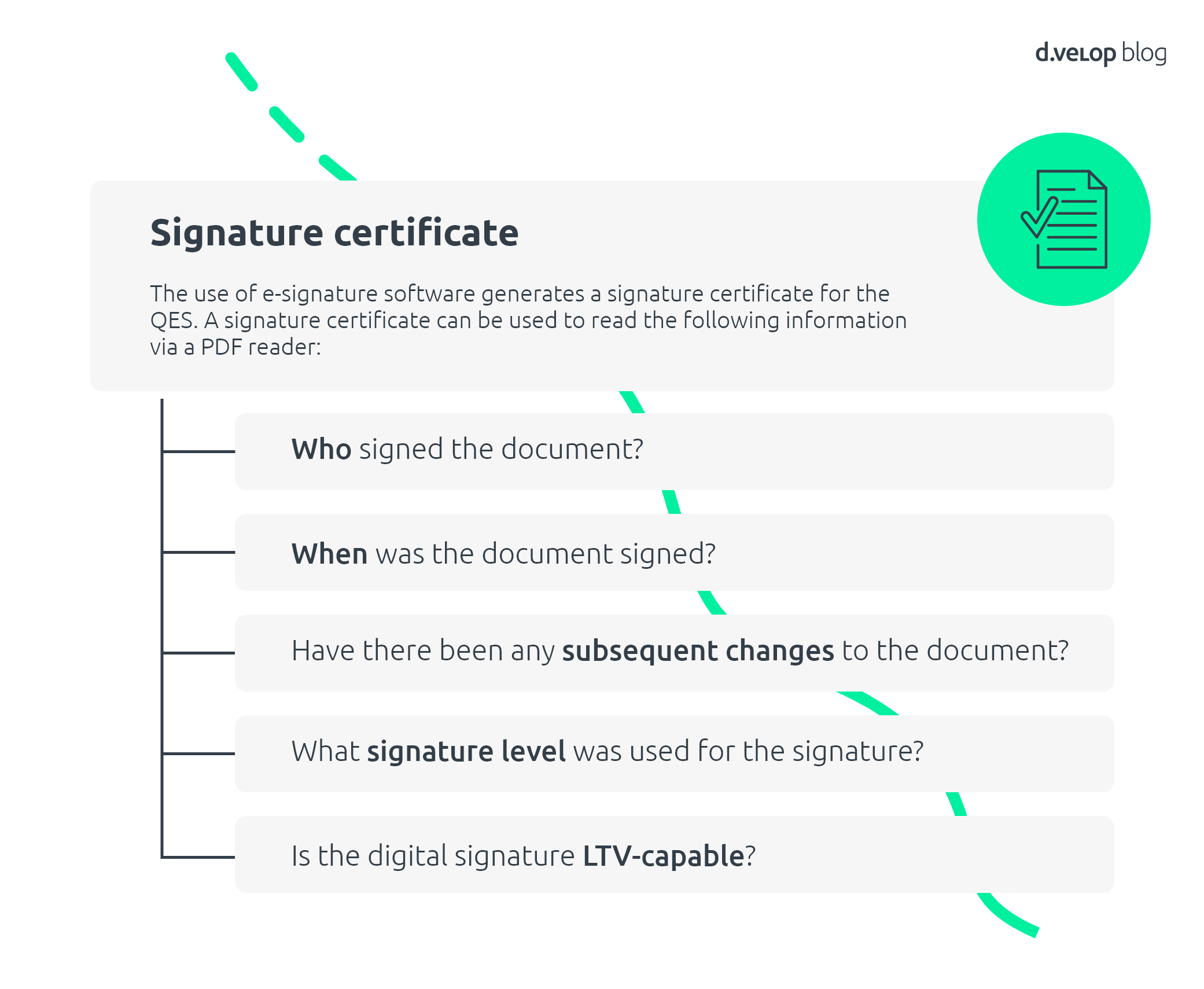

- A signature certificate is generated and the signature process is finalised.

A signature certificate is generated when the qualified electronic signature is applied. The following information can be read from the signature certificate, e.g. via a PDF reader:

- Identity of the signatory: Who signed the document?

- Time of signature: When was the document signed?

- Security level: What signature level was used to sign the document? (advanced or qualified)

- Integrity protection: Were there any subsequent changes to the document?

- Validity: Is the digital signature LTV-capable? (Long Term Validation)

Thanks to the signature certificate, the qualified electronic signature is even more secure in the corporate context than the traditional pen and paper signature. This is because information can only be unambiguously retrieved via the certificate. With the analogue method, on the other hand, there are residual risks, such as forged signatures.

What are use cases for the qualified electronic signature?

In order to understand the application scenarios of the qualified electronic signature, it is worth taking a look at the statutory formal requirements for certain contracts. In the worst case, contracts that do not comply with the legally prescribed form are void and can be subsequently contested. In order to preserve the binding nature of contracts, it is therefore essential to comply with these formal requirements. But what does this mean for the qualified electronic signature (QES)?

In principle, the qualified electronic signature should be used if there is a legal or contractually agreed written form requirement for a document or if there is a high liability risk for your own company. A trusted lawyer should therefore always be consulted for your own assessment. In which areas is the qualified electronic signature used particularly often in the company? To clarify this question, we sat down with external, independent lawyers and drew up recommendations for various departments on possible use cases:

- Human resources: (Non)fixed-term employment contracts, law on the provision of evidence (NachwG), temporary employment, post-contractual non-competition clause, applications for short-time working, objection to transfer of business, payroll accounting, parental and care leave requests, AGG

- Real estate / facility management: (Indefinite) fixed-term rental agreements, lease agreements, termination of residential rental agreements, objections to terminations, self-disclosures, brokerage agreements, service contracts in connection with real estate operations, handover protocols, option exercise letters

- Management / Board of Directors: Share purchase and transfer agreement (SPA), shareholder agreement (SHA), shareholder loans, shareholder resolutions, powers of attorney

- Insurances: AVB, IPID, customer information (VVG-InfoV), waiver of pre-contractual information, advice protocol, waiver of advice, obligation of the policyholder to notify, obligation of the insurer to ask questions, obligation of the insurer to inform, contract application, contract amendment, insurance policy, notification of the insured event

- Further use cases

The qualified electronic signature sets new standards in the digital working world

The qualified electronic signature is the digital counterpart to the traditional signature with pen and paper. For rational companies that attach great importance to process quality and cost reductions, there is no way around the qualified electronic signature. The e-signature will establish itself as the new standard in contract management for companies in every sector and enrich the everyday working lives of many people. Compared to other projects in the course of digital transformation, the e-signature is a small digitalisation module that can be implemented quickly and at short notice in a company’s software architecture.