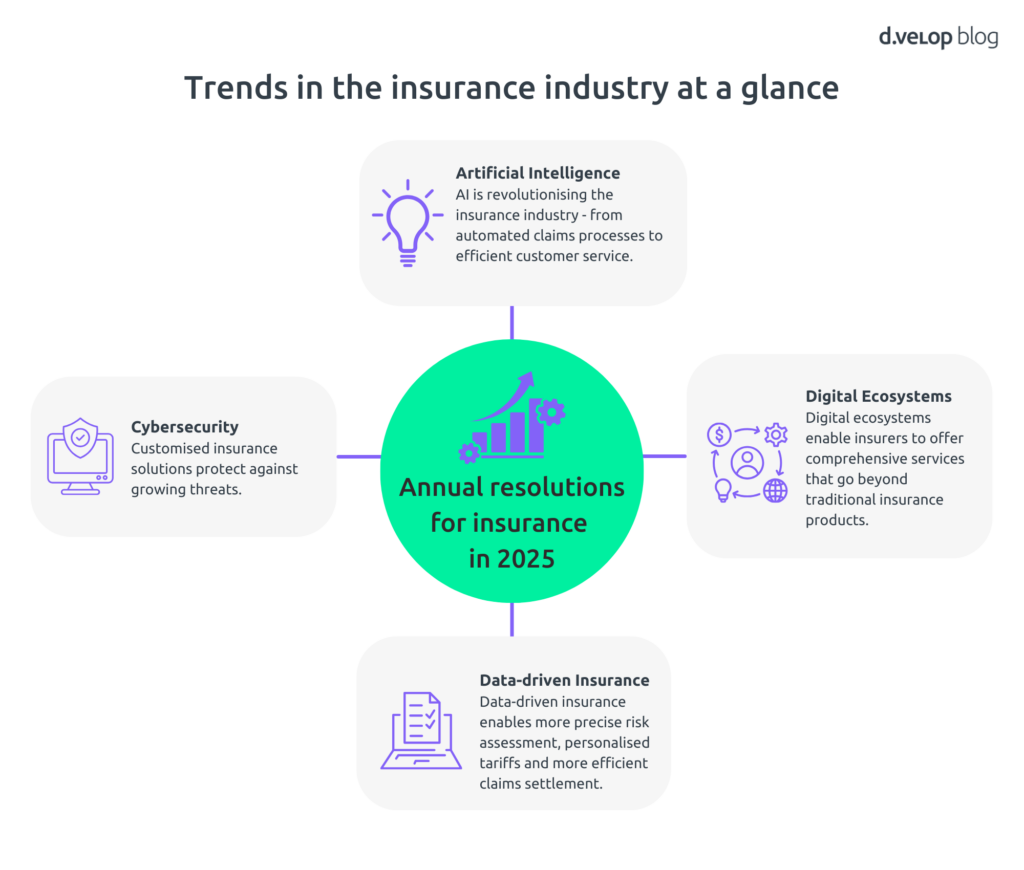

The year 2025 brings numerous changes and innovations in the insurance industry once again. To stand out from the competition and sustainably improve the customer experience, it is important to set clear goals and leverage current trends in the insurance sector. The past few years have shown that those who create a solid foundation and closely monitor the market are successful in the long term. Moreover, responding to trends early is crucial. Take this opportunity and implement these four trends to make 2025 more sustainable, digital, and successful.

Trend 1 in the Insurance Industry: Digital Ecosystems

The first major trend in the insurance industry is digital ecosystems. They enable insurers to offer comprehensive services that go beyond traditional insurance products. By integrating partners and services, such as healthcare services, financial advice, or smart home technologies, insurance companies can provide their customers with a seamless and holistic experience. These ecosystems promote customer loyalty by offering added value to customers. Simultaneously, they open up new business opportunities for insurers.

The key to successful ecosystems lies in seamless digital integration – and this is where appointment and customer management become crucial. Insurers need to integrate their customer dialogue into platforms and digital channels to provide a consistent experience.

Trend 2 in the Insurance Industry: Data-driven Insurance

A data-driven approach will be a central strategy to keep pace with changing market conditions in 2025. By intelligently utilizing your insurance data, you have the opportunity to create personalized customer experiences. Furthermore, you can make more precise and individualized risk assessments. However, data-driven insurance can only work if your employees can access all relevant insurance information.

With an effective document management system that meets regulatory requirements and permission structures, you create a solid foundation. When supported by artificial intelligence, you say goodbye to confusing data silos. This way, you can recognize changes in customer behavior and trends in the insurance industry early. Consequently, you can act in a customer-oriented manner.

Trend 3 in the Insurance Industry: Cybersecurity

As in the previous year, cybersecurity remains a major topic in 2025. With increasing digitalisation and the shift of data and processes to the cloud, the importance of cybersecurity in the insurance industry continues to grow. Insurance companies should invest more in security measures to protect themselves against the growing threat of cyberattacks. This helps secure their customers’ sensitive data.

Implementing advanced security protocols and using AI to detect and counter threats are crucial to ensuring the integrity and confidentiality of data. Additionally, training employees on security issues plays an important role in minimizing human errors. This helps maintain a high level of security.

The security of IT systems must be a top priority for insurance companies more than ever. Sensitive, personal data must be protected to prevent it from falling into the hands of digital thieves. To ensure that your document management system is secure, you can adhere to the following security standards:

- DIN EN ISO/IEC 27001:2017

- GDPR-compliant

- VAIT-compliant

Cybersecurity remains a central aspect to gain your customers’ trust. It ensures the stability of your insurance company in an increasingly connected world.

Reimagining Insurance 🚀

Discover how the three pillars people, process, and technology are crucial for navigating digital transformation and achieving a competitive edge in the rapidly evolving insurance sector.

Trend 4 in the Insurance Industry: Artificial Intelligence

Yes, the topic of artificial intelligence is everywhere at the moment, but in the insurance industry for 2025, it plays a particularly transformative role. AI is revolutionizing the way insurance companies operate. It does so by automating processes, increasing efficiency, and improving the customer experience.

From claims processing to fraud detection and customer interaction, AI-driven systems and chatbots enable insurers to act faster and more accurately. This not only leads to cost savings, but also to higher customer satisfaction. Additionally, AI helps to better assess risks. Insurers can offer personalized insurance products that are precisely tailored to the needs of customers.

Overall, it is evident that AI is not just a trend. It is an essential component of the future development of the insurance industry.

New Year’s Resolutions for Your Insurance

2025 will be another year full of changes and innovations in the insurance industry. With these resolutions, you can future-proof your insurance and make 2025 a successful year. Stay innovative and focus on sustainable solutions to stay ahead of the competition.

Experience how digital solutions can advance the insurance!

Talk to our experts without any obligation. Watch as the software comes to life and ask any questions you may have in real-time.